The Perfect Storm For Massive Bitcoin Adoption

Bitcoin celebrated its 11th year on October 2019 and trades billions of dollars per day in financial institutions such as CME (Chicago Mercantile Exchange), BAKKT (owned by NYSE’s ICE) and Fidelity Investments. As the world braces for a global recession, Bitcoin may attract massive interest by main street investors in the coming weeks.

Another Global Financial Crisis

“In fact, we anticipate the worst economic fallout since the Great Depression”.

Kristalina Georgieva Managing Director of International Monetary Fund (IMF)

The world has essentially come to a grinding halt. Our debt-fueled economy was due for a much expected recession when COVID-19 paralyzed the world. The virus accelerated the downward spiral and the international financial system now braces for a monumental collapse.

A decade since the last recession, we are watching yet another global financial meltdown. As governments and central banks attempt to take control of the unprecedented crisis, the world population is at risk of a financial catastrophe.

Over-leveraged companies are going bankrupt; traumatized stock market reacts wildly to foolish optimism by Federal Reserve’s patchwork; global demand for commodities such as oil and timber has plummeted; investors have lost confidence in the world economic super-power by dropping Treasury bond yields to negative rates; and the Fed continues to print money with Infinite QE (Quantitative Easing) risking the fall of the US Dollar and high inflation.

Weak Correlations and Confusing Value Models

“Forget ‘recession’: this is a depression”

David Blanchflower and David Bell – The Guardian

As panicked investors scramble for safety and sound advice, experts provide conflicting views trying to fit a round peg in a square hole. Decades of uncontrolled Capital Darwinism and mass speculation has distorted the correlations between company valuations and true health of the economy.

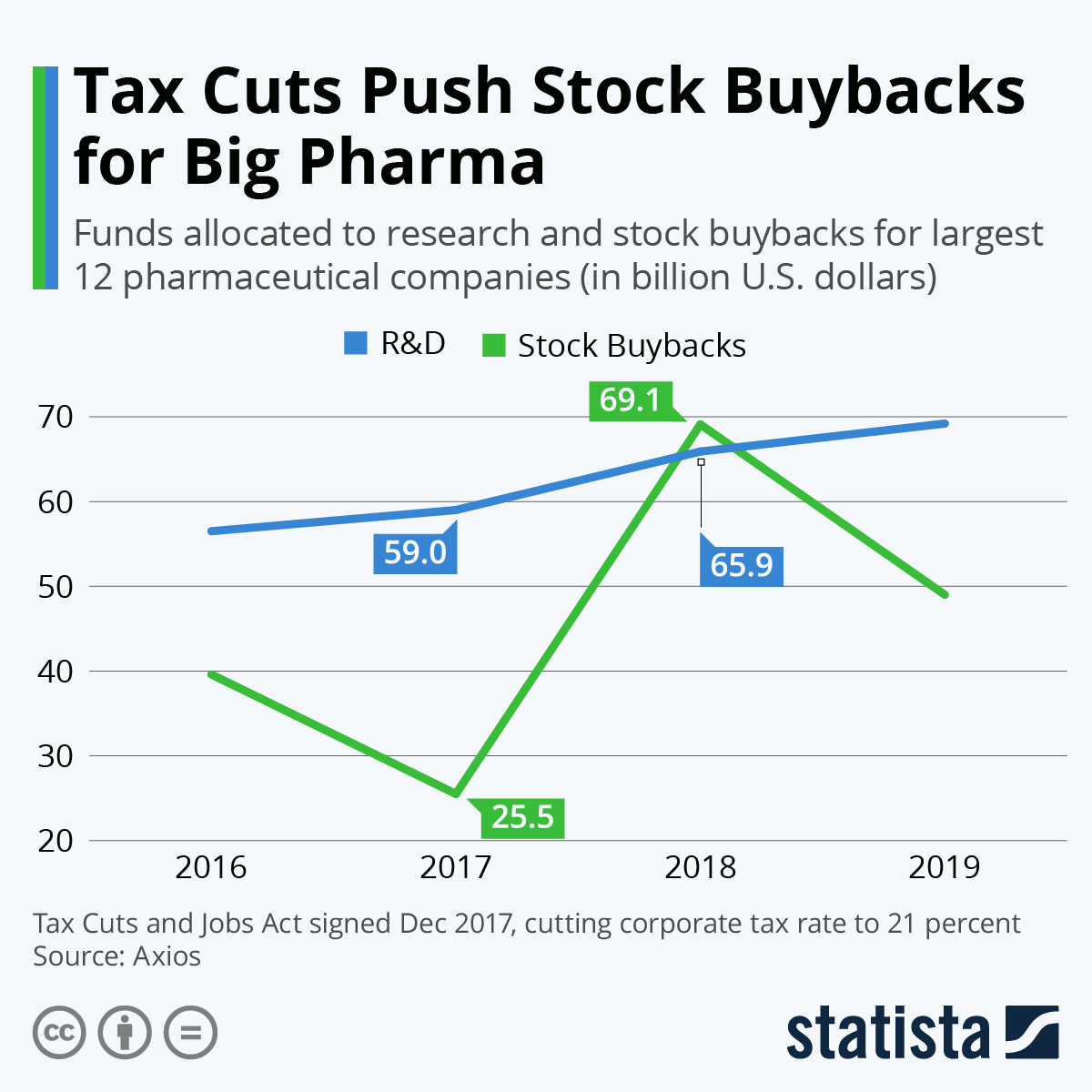

Creating no fundamental value and misrepresenting financial markets as signs of a strong economy, corporations artificially inflated stock prices for shareholder dividends and executive bonus compensations based on EPS (earnings-per-share). Adding to the confusion, recent rallies in the stock market resemble more like pyramid schemes than investments in real value.

Paradigm Shift

“In paradigm shifts, most people get caught overextended doing something overly popular and get really hurt. On the other hand, if you’re astute enough to understand these shifts, you can navigate them well or at least protect yourself against them”.

Ray Dalio on Linkedin

After witnessing Wall Street’s longest bull run, the global recession is igniting an economic paradigm shift. Traditional school of value-investing no longer applies. Simple 60/40 (stocks and bonds) and diversifying through ETFs or index funds all fail to produce during a paradigm shift.

Bitcoin was created as the antibody that plagued our defective monetary system. In recent years when the world could no longer ignore the proven value of Bitcoin, economists and financial experts struggled to correlate Bitcoin with traditional models when, in fact, Bitcoin is a non-correlated commodity. Bitcoin is the paradigm shift.

Diversification

“It aims to maximize returns by investing in different areas that would each react differently to the same event”.

Investopedia – “The Importance of Diversification”

Bitcoin was born from the aftermath of 2008 financial crisis and continues to trade in the world’s biggest markets.

Verified and recorded on the blockchain, Bitcoin is not issued by governments nor is it controlled by central banks. Priced 24 hours a day around the world in Euros, US Dollar, Yen, and many more, Bitcoin could become the new gold standard, the ultimate scarce commodity of just 21 million ever to be available and the truly inflation-resistant asset coded into the blockchain.

There is a storm coming. It is a financial tsunami that will collapse the global economy. If diversification is key to minimizing the impact of the imminent recession, it would be pure ignorance not to include Bitcoin in our investment basket.

About the author:

Andrew Lim has worked in the financial market since the late 1980’s. He is currently President and CEO at SKBC Co. Ltd. (South Korea Blockchain). He has been an Advisor and Mentor at Bitcoin Center Korea for over 2 years.

Contact Andrew Lim at:

SKBC Linkedin Twitter: @skbitcoin