From pump and dump groups to insiders trading on esoteric knowledge, market manipulation is rampant within the cryptocurrency space. While some of it is illegal, most of the activity is either legal or quasi-legal, falling into the sea of grey that separates lawful land from unlawful territory. Everyone knows that market manipulation is endemic. The question is, does anyone care?

Also read: Warren Buffett: Bitcoin is Gambling, a Game, Not an Investment

In the Beginning, There Was Fontas

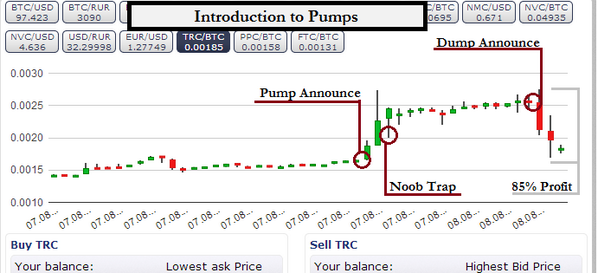

Traders have been manipulating the cryptocurrency markets since day one. In bitcoin’s earliest days, it and the altcoins that existed on a handful of illiquid exchanges were ripe for pumping, dumping, and then pumping again. Coins were won or lost in a heartbeat which, back then, were worth buttons. In hindsight, traders should have just hodled, as those $1 litecoins proved to be worth a whole lot more five years down the line (feathercoin and terracoin not so much).

One trader whose pseudonym was synonymous with pump and dumps back in 2014 was Fontas. Often these schemes would be orchestrated through the trollbox on Btc-e, an exchange whose attitude to illegal activity was laissez-faire to say the least. No one knows how much BTC Fontas made from preying on noobs who arrived late to the pumps he orchestrated with the promise of dropping “1 BTC buy bombs” to keep the green candle rising.

Phase II: Private Pumps

As the cryptocurrency markets started to mature, manipulation didn’t go away: it just went private, moving from public chatboxes to invite only Slack, Discord, and Telegram groups. The objective was still the same though: to buy cheap, force the coin to pump (now by spreading fake news about partnerships and other bullish signals) and then dumping at the top.

But pump and dumps are only one form of manipulation, and are arguably one of the more benign attempts at profiteering. Their effects are short-lived, and any trader who blindly chases a rising candle without understanding why it’s rocketing deserves little sympathy. Other attempts at gaming the system are more subtle and are not explicitly illegal, but their effects can be insidious. Examples include:

- A developer who bulk buys a shitcoin and then suggests dual forking it with bitcoin to inflate the price

- A major exchange that tells its cronies about an imminent coin listing, allowing them to secure a position before the masses pile in

- A cryptocurrency team that buys more of its own coin prior to announcing a major partnership

- A whale trading group that secures a discounted private sale allocation and then shills the ICO to the masses to ensure FOMO

Don’t Hate the Trader, Hate the Game

Every second of every day, traders are trying to game the system and steal whatever advantage they can over their peers. Whales creating fake sell walls to psych out the market; Twitter traders taking positions before shilling the coin as an undiscovered gem; FUDsters FUDing; bots buying; wash traders washing. Everyone’s at it, and while most people aren’t breaking the law in the pursuit of profit, there’s a case for saying that manipulation should simply be accepted as part of life.

Every second of every day, traders are trying to game the system and steal whatever advantage they can over their peers. Whales creating fake sell walls to psych out the market; Twitter traders taking positions before shilling the coin as an undiscovered gem; FUDsters FUDing; bots buying; wash traders washing. Everyone’s at it, and while most people aren’t breaking the law in the pursuit of profit, there’s a case for saying that manipulation should simply be accepted as part of life.

It’s been going on in the world of finance since day one, with insider trading and stock manipulation some of the oldest tricks in the book. Exchanges such as Bittrex and Cobinhood have condemned such behavior and the CFTC has offered pump and dump whistleblowers a $100k bounty. But given the inability of prosecutors to catch even a fraction of financial lawbreakers, what hope is there of headway in the free and easy world of cryptocurrency?

Everyone’s At It

A widely-shared Steemit post exposed blatant attempts to manipulate an altcoin, but many who read it demurred with the author’s assertion that a crime of the highest order had been perpetrated. “I’ve already contacted the SEC, FBI and other federal authorities regarding their activities on the market. I have all intentions of making an in-person visit either today…or tomorrow to deliver all of these screenshots,” they vigorously concluded. Some would argue that crypto users crying foul to the three-letter agencies is counter-productive and the last thing the community needs.

In his recent autobiography, “A Higher Loyalty”, former FBI director James Comey recalled his decision to prosecute Martha Stewart for insider trading when he was Attorney General. The sum the cooking magnate had cashed in was trifling – around $50,000 worth of stocks – but she was prosecuted in the end because there was clear evidence showing she had benefited from insider information and later lied about it. Most cases, Comey conceded, are unprosecutable because it is hard to prove the reason behind someone buying or selling an asset. Offloading a stock just before it dumps could be nothing more than a coincidence.

How to Deal with Market Manipulation

Given the impossibility of eradicating market manipulation, it may be wise to seek a more pragmatic solution. One is for the crypto community to continue publicly condemning such behavior, while in private accepting that nothing can be done about it. The alternative is to embrace manipulation and accept it as part of the cut-and-thrust of trading. This notion isn’t as outlandish as it might sound: some people believe that doping should be allowed in professional sport because if all athletes dabbled, it would create an even playing field. Who’s to say that shilling a coin on Twitter is any more ethical than pumping a shitcoin in a private group, or profiting off the inside scoop on Coinbase’s next token listing?

When Martha Stewart emerged from her short prison sentence in 2005, it was to find that her fortune had increased by $200 million. Ironically, a few months away from trading could be the most profitable thing a crypto investor does. When the punishment is more profitable than the crime, there’s a case for saying that prosecution is pointless. Manipulators gonna manipulate and insider traders gonna inside trade. It’s just human nature.

Do you think market manipulation is inevitable and should it be illegal? Let us know in the comments section below.

Images courtesy of Shutterstock, Wikipedia, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post Cryptocurrency Market Manipulation Is Rife – But Does Anyone Care? appeared first on Bitcoin News.

Powered by WPeMatico