This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release. Crowd Genie Financial Services Pte Ltd (“Crowd Genie”), an operator of a Peer-to-Peer (“P2P”) lending platform licensed by the Monetary Authority of Singapore (“MAS”), looking to build an Asia-wide exchange of financial assets through its related entity CGSPV Pte. Ltd., today announced the appointment of…

Read MoreCategory: cryptocurrencies

Dr. Doom (Professor Nouriel Roubini) Calls Stablecoin Tether a Scam

It’s no longer just anonymous internet trolls calling out Tether on twitter. One of the most influential economists in the world today, Nouriel Roubini, has just entered the debate, coming down hard against the controversial company. Also Read: Analyst: IOTA Sharply Overvalued Due to “Overwhelming Evidence of Serious Flaws” Dr. Doom vs Tether Renowned economics professor Nouriel Roubini (commonly known as Dr. Doom) has called out Tether today for being a scam meant to artificially prop up the price of bitcoin. He thinks that without this “criminal manipulation” the price…

Read MoreSwedish Bank Nordea Forbids Employees from Trading Bitcoin

Reports have emerged that the Swedish banking giant, Nordea, has forbidden its employees from trading Bitcoin and other digital currencies. No More Bitcoin Trading Swedish bank Nordea has ordered all of its employees to stop trading in cryptocurrencies. According to a recent report by Reuters, the Nordic region’s biggest bank has forbidden its 31,000 employees from trading Bitcoin due its high risks and volatility. A spokesman for Nordea told Reuters: The risks are seen as too high and the protection is insufficient for both the co-workers and the bank. Nordea’s decision surprised many…

Read MoreBitconnect Faces Lawsuit for Operating “Wide-Reaching Ponzi Scheme”

Bitconnect is facing litigation from six individuals accusing the company of operating a Ponzi scheme in addition to numerous violations of securities laws. The six plaintiffs collectively invested approximately $771,000 USD into Bitconnect, and are seeking recourse following the sudden removal of the company’s lending platform that immediately led to a more than 90% loss in the value of Bitconnect tokens. Also Read: Not Content Scamming $1.5 Billion, Bitconnect Wants Another $500 Million for ICO Bitconnect Receives Class-Action Lawsuit The complaint has been filed by Charles Wildes, Francisco Doria, Aric Harod,…

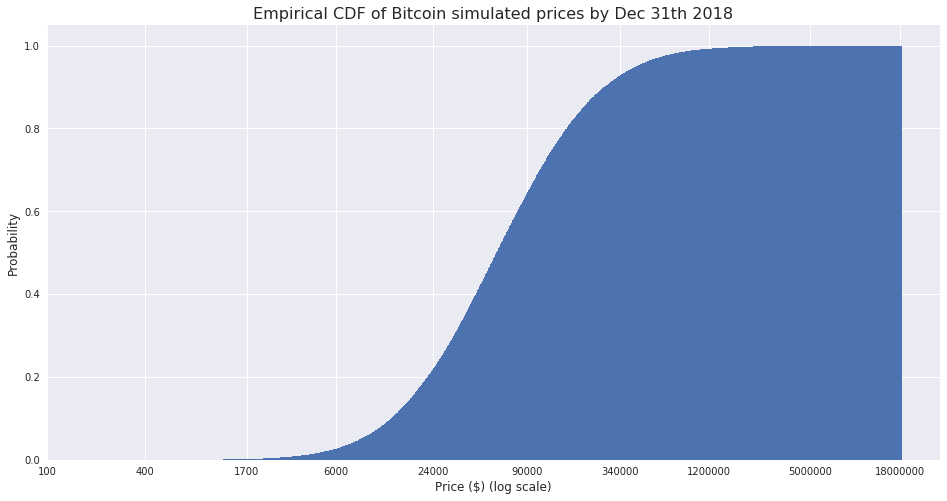

Read MoreBitcoin 2018 Price Projection Using Monte Carlo Random Walks: ~50,000 USD

Using the Monte Carlo statistical projection method, combined with what are known as random walks, Xoel López Barata developed some pretty fun bitcoin price scenarios for the end of this year. His projections are compelling because he follows data, revealing the difficulty being able to accurately prophesize much about the world’s most popular cryptocurrency’s path. Also read: Tezos Swiss Foundation Concept is “Old, Inflexible and Stupid” Monte Carlo Projection Method Xoel López Barata recently published a pretty great thought experiment. Mr. Barata ran a simulated price projection for all of…

Read MoreFX Platform Integral Now Covers Bitcoin, BCH and a Dozen More Cryptocurrencies

As more FX traders are demanding access to the hottest market these days, all banks and brokers will have to respond sooner rather than later to keep their clients. Institutional technology providers are seeing this unfold and are starting to lay the groundwork for a new financial order. Also Read: Oil Company Wants to Sell Bitcoin ATMs to Casinos, Stock Jumps 60% Cryptocurrency is Now Completely Integral to FX Trading Integral, the Palo Alto headquartered institutional FX cloud platform, has expanded its market data offering for cryptocurrencies to include fourteen major…

Read MoreRobinhood Targets Millennials with Free Crypto Trading

Robinhood, the self-acclaimed fastest-growing online brokerage in history, is getting into cryptocurrencies. It will be offering zero commission crypto trading starting in February. Not quite stealing from the rich and giving to the poor, but opening to crypto trading is certainly a step in the right direction for the US company. Robinhood is a big hit with millennials as it reportedly has 3 million users with a median age of 26. Venturing into crypto will be a huge boon for a generation that is already hungry for Bitcoin and its…

Read MoreICOs Review Token Prices in Line with Cryptocurrency Growth

After a period of continued growth, ETH and BTC prices have recently fluctuated significantly, with the bitcoin price peaking at over $19,783 on December 17, 2017, before falling to $14,129 on December 31, 2017, and then to its current value of approximately $10,654 (according to the CoinDesk BitCoin Price Index). Owing to sustained cryptocurrency growth in 2017, before the downward adjustment in January 2018, a number of ICOs have perceived a need to lower their token prices in a bid to stay ahead of the market. For example, SocialMedia.Market has…

Read MoreGoldman Sachs CEO: ‘Bitcoin Trading Desk Rumors Are Not True’

According to multiple reports back in October and December of last year, it was said that the financial institution Goldman Sachs had plans to create a bitcoin trading desk. Now a month later, Lloyd Blankfein, the CEO of the firm, says the reports are “not true” speaking at the World Economic Forum in Davos this past Wednesday. Also read: Championing Decentralized Exchanges, Now Might Be the Perfect Time for Bisq Goldman Sachs CEO Denies Opening a Bitcoin Trading Desk A while back in October, publications started rumors that the banking…

Read MoreCFTC Files Against ‘My Big Coin’ for Scamming $6 Million USD

The Commodity Futures Trading Commission (CFTC) has filed a lawsuit against “a virtual currency know as My Big Coin (MBC).” The CFTC alleges that the company raised more than $6 million USD by making false and misleading claims regarding the cryptocurrency’s utility and backing. Also Read: Vouching Bitfinex and Tether’s Bank Accounts Hold Nearly $3 Billion USD My Big Coin Latest Virtual Currency to Be Targeted by CFTC The CFTC accuses My Big Coin of “misappropriating over $6 million from customers […] and using those funds for personal expenses and the purchase of…

Read More