Bitcoin markets and cryptocurrency markets, in general, have been declining in price for the past six weeks straight with a few bounces here and there. Currently, BTC/USD markets have reached the lowest price in weeks touching $6,600 on February 5, 2018, erasing the past three months worth of gains.

Also Read: China Censors Cryptocurrency Ads on Search Engines and Social Media

The -65 Percent Bitcoin Dip

Many cryptocurrency enthusiasts and traders are in search of the cryptocurrency ‘bottom’ — the price position where the asset will go no lower and is usually followed by a price rise. Today BTC hit a low of $6,600 across most global exchanges around 2 pm EDT. At the moment the BTC/USD global average is hovering just above the $7,000 region after passing through the $9-8K territories two days prior. At the time of publication BTC markets are down -65 percent since the December 16 all-time high. Over the past 12-hours, trade volume has been weak at under $6Bn traded over the past 24-hours, but that metric has increased since the dip. The top five exchanges trading the most BTC at the moment include Bitfinex, Okex, Binance, GDAX, and Bitstamp. The Japanese yen is the most dominant currency traded right now with BTC as the yen captures 40 percent of global trading. This is followed by the USD (36%), tether (USDT 10%), the euro (7%), and the Korean won (2%).

Technical Indicators

Looking at the daily, 4-hour, and 30-minute charts show blood is in the markets and there is a whole lot of sell-off happening. The two Simple Moving Averages (SMA) both short (100) and long-term (200) had seemed to be coming close to convergence. However, the two trend lines have spread once again, and the 100 SMA is sinking below the 200 SMA. This indicates the bearish sentiment is still in high gear for the time being. The Macd was barreling well below recovery territories as well, suggesting a high period of sell-off; however, after touching $6,600 volumes, it started to heat up.

The Relative Strength Index (RSI) and Stochastic oscillators show a bit of indecision at the time of publication as we may see some recovery in the short term. The current bounce back to $7,000 shows this may be the case. Order books across multiple exchanges show very little resistance towards the $7-8K price zones if bulls can muster up some strength. On the back side, foundations are relatively solid until $6,100 at that point, there is a steep buy wall the size of Mt Everest. However if this underpinning breaks then $5K price levels will likely be imminent.

Digital Asset Markets, In General, Are Suffering Deep Losses

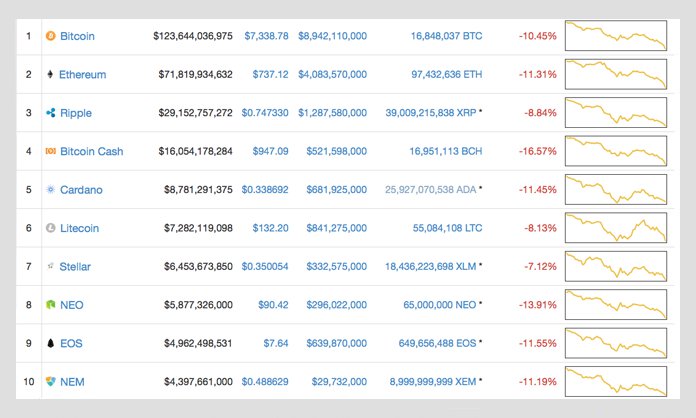

The top ten cryptocurrencies are all suffering from extreme losses today. The second largest market cap held by ethereum (ETH) is down 11 percent, and one ETH is trading at $737. Ripple (XRP) markets are down 8 percent as one XRP is $0.74. Bitcoin cash (BCH) prices dropped 16 percent to a low of $947. Lastly, Cardano (ADA) dropped to $0.33 today seeing an 11 percent loss over the past 24-hours.

Most traders in forums and Telegram chats have been trying to call the ‘bottom’ for a while now. Some still believe we could even touch lower bound prices around $4.5K per BTC in the near term. Some think a reversal will take place soon and prices between $13-15K could be reached by March. Overall the bearish sentiment has eclipsed most signs of positivity and the euphoric feelings traders felt just six weeks ago.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Bitcoin Wisdom, AP, and Coinmarketcap.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: BTC Prices Suffer from a 65% Loss Since December appeared first on Bitcoin News.

Powered by WPeMatico