If there’s one thing a crypto recession’s good for, it’s rebuilding. It’s debatable whether we’re in a full-blown recession admittedly, but whatever you wanna call it, the charts ain’t looking too pretty. The upside to that is it’s a great time for looking elsewhere. With Easter imminent, it seems fitting that some of crypto’s biggest players should be focusing on renewal: new blockchains, new miners, new scaling solutions, and new licenses. This week in bitcoin, the great build begins.

Also read: Paypal Users Receive Cryptocurrency Warning Email

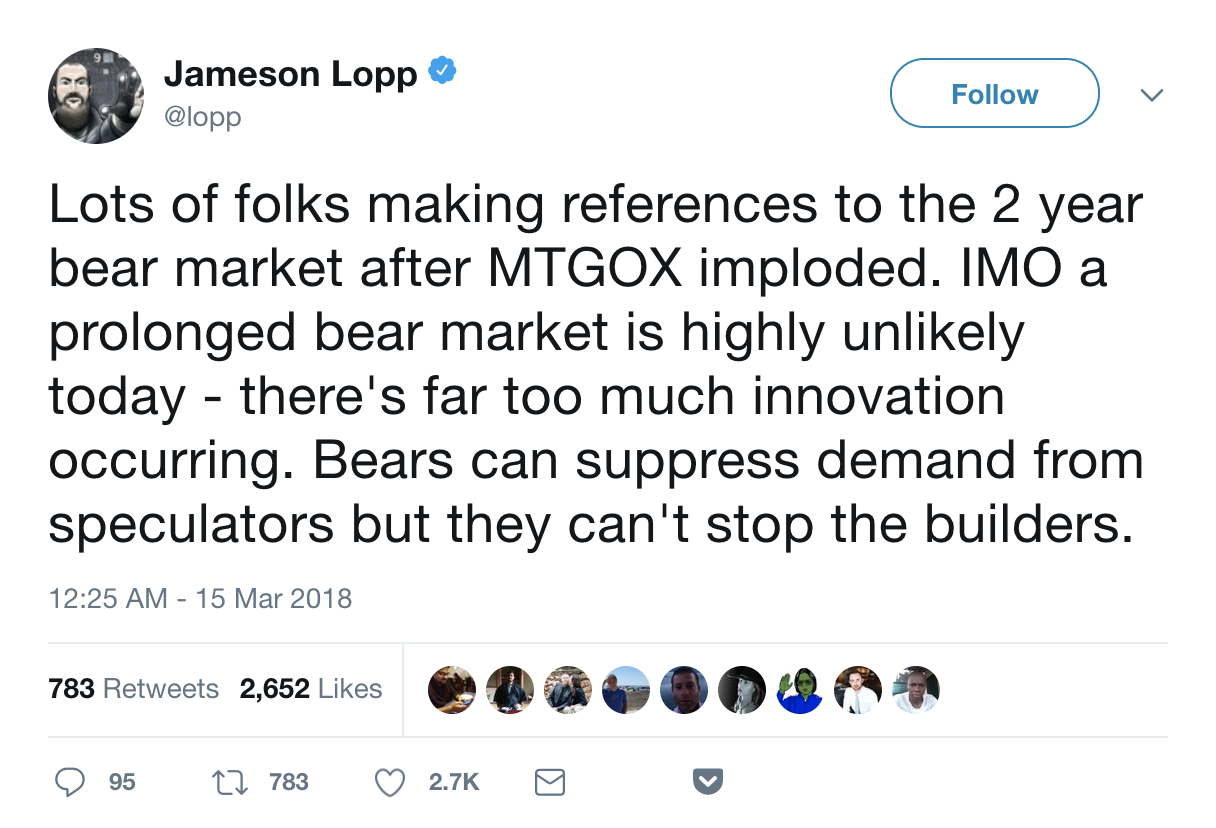

From HODL to BUIDL

If HODL is what we do with our crypto, BUIDL is what we do when our coins are no longer worth HODLing. It’s fair to say that most of us still believe in bitcoin as much as ever, but are capable of conceding that it may be a few months till we witness another ATH…or even $10k, the way things are looking right now. That’s okay though, cos away from the price action, there’s lots happening behind the scenes as crypto’s heavy hitters begin to build.

Binance was first out the traps, announcing plans for its own blockchain, decentralized exchange, and god knows what else. They’ve got cash to burn, as tends to be the case when you’re pulling in over $800 million a year, and aren’t afraid to put a chunk of it to good use. Coinbase, the Facebook to Binance’s Google in crypto terms, haven’t been resting on their laurels either. They’ve gotten their hands on a coveted e-money license from UK regulators, which will aid their European expansion efforts.

With the recent recruitment of Linkedin’s Emilie Choi, who specializes in M&As, it’s suspected that Coinbase might be plotting to snap up promising startups and assimilate them into its mushrooming empire. Compliance; finance; insurance. All of these sectors, and many more, could be prime targets should Coinbase decide to embark on an M&A sweep.

Some Call It Recession, Some Call It Renewal

On the face of it, stories like Binance building its own blockchain and Barclays breaking rank to become one of the first major banks to support crypto (having accepted Coinbase as a UK client) sound bullish. And while it’s true that these initiatives bode well for the future of cryptocurrency, why does it take nine years for a British bank to accept bitcoin, and only then via Coinbase, the most corporate and squeaky clean company in the entire space? What about all those aspiring startups that were turned down for banking facilities as soon as the word “cryptocurrency” was mentioned? And not just in the UK, but everywhere. In crypto, as in the world at large, it seems to be less what you know, and more who you know.

When we talk about the crypto rich, it’s normally whales who spring to mind; those faceless, nameless entities with the power to move entire markets with a single trade. But the biggest whales of all aren’t our fellow traders: they’re the exchanges themselves with the wealth to survive the longest crypto winters and to emerge with an even greater stranglehold on the market.

When we talk about the crypto rich, it’s normally whales who spring to mind; those faceless, nameless entities with the power to move entire markets with a single trade. But the biggest whales of all aren’t our fellow traders: they’re the exchanges themselves with the wealth to survive the longest crypto winters and to emerge with an even greater stranglehold on the market.

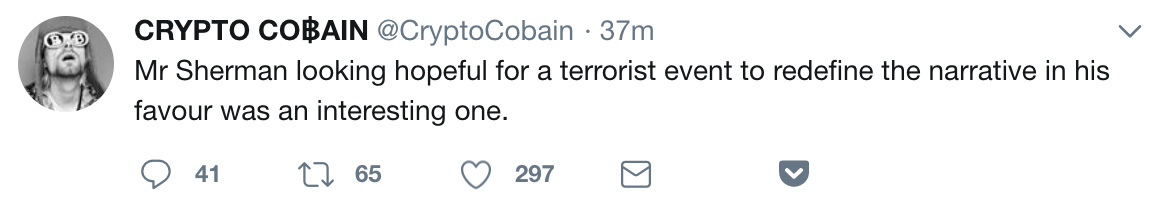

Senators Talk Smack About Crypto

On Wednesday, a Senate hearing convened to discuss ICOs and there were some interesting comments from Representatives, ranging from the bullish to the brain-dead. These events are turning into high caliber popcorn material for crypto Twitter, who were on top form throughout the live streamed debate. Brad Sherman took the biscuit for conflating cryptocurrency with terrorism, with only the IMF’s Christine Lagarde running him close for spewing baloney this week.

The doom and gloom coming from the IMF and from the Senate’s more benighted representatives makes John Oliver’s cryptocurrency special last Sunday night seem veritably upbeat. To paraphrase the British comic, it’s astonishing that in the current year we should still be hearing cryptocurrency linked with terrorism. The two are no more interconnected than potato chips and terrorism. Just because a few freedom fighters are partial to a bag of Lay’s doesn’t make chips synonymous with terrorism.

Peering Into the Future

If crystal balls actually worked, we’d all be using them to divine the fate of the crypto markets. Instead, monitoring bitcoin futures predictions is the closest we get to determining which way the candle’s gonna drip. The short-term future is looking bleak, apparently, but at least contract volumes have increased, which has gotta count for something, right? We’ll also soon be stepping into a future devoid of Google ICO ads, and Twitter crypto ads too, which is probably for the best. This week’s most popular post, incidentally, was a retrospective, examining the events that caused bitcoin’s 70% drop from its December peak, but it contains clues in there regarding how to sell at the top – next time we get to the top.

Finally, there’s been a sliver of good news for traders concerned by whale-sized sell-offs further depressing prices: Mt Gox’ trustee has promised that his selling strategy has been designed to as not to affect the markets. That might be of scant consolation now, but when the markets begin to recover, as they surely will, this knowledge may help to soothe troubled souls. In the prison system, they say there’s only two days that count: the day you arrive and the day you leave. Similarly, there’s only two prices that matter with crypto: the one you buy at and the one you sell at. Everything in between is just noise.

What was your favorite story from this week in bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

The post This Week in Bitcoin: Time to Build appeared first on Bitcoin News.

Powered by WPeMatico