The association comprising of 16 government-approved cryptocurrency exchanges in Japan has reportedly provided a sneak peak of its self-regulatory rules. The focuses are on banning insider trading and preventing exchanges from listing privacy coins.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Insider Trading Banned

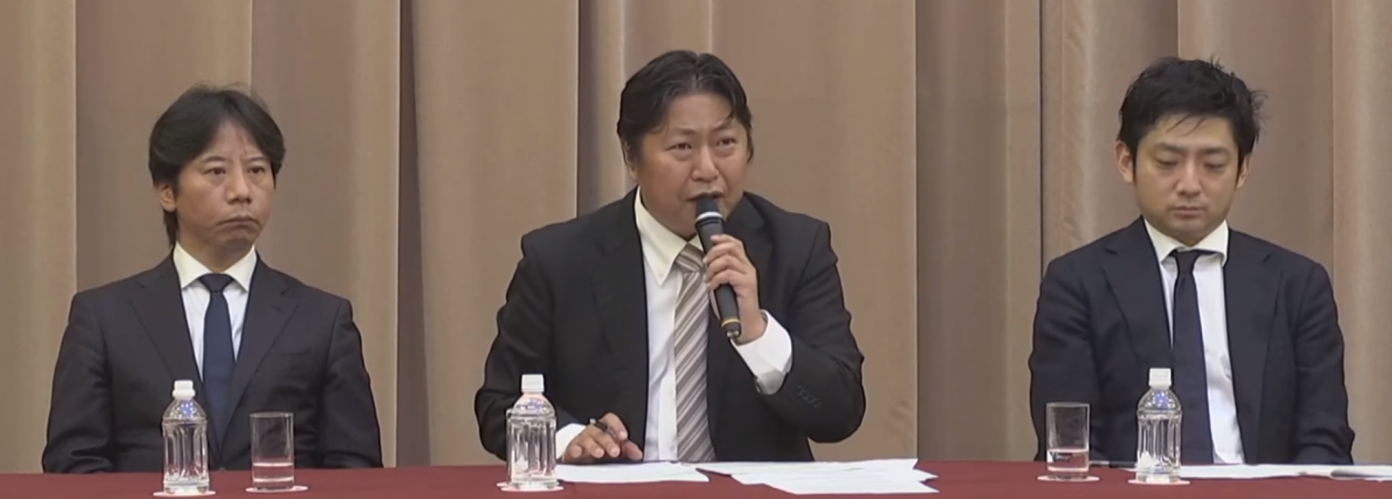

The Japan Virtual Currency Exchange Association (JVCEA) has given a sneak peak of the draft self-regulatory rules it has been working on, “in an effort to step up consumer protections and improve transparency,” Nikkei reported on Monday. The main focuses of the new regulations are on “insider trading and the trading of new currencies that cannot be traced easily,” the publication detailed, adding:

The proposed rules explicitly ban insider trading. Word has leaked previously that a major exchange would start handling a new currency, which led to a surge in the currency’s value and left many suspecting market manipulation. Such activity would represent a clear violation of the new rules.

Privacy Coins and Other Restrictions

Previously, news.Bitcoin.com reported that the country’s top financial regulator, the Financial Services Agency (FSA), had pressured exchanges to drop privacy coins. Nikkei soon reported that the agency intended to introduce a rule banning them. Subsequently, Coincheck delisted XMR, DASH, and ZEC.

According to the news outlet, the JVCEA has also introduced its own rules on privacy coins, stating:

The association also wants to prohibit exchanges from accepting new currencies that cannot be traced to previous sellers, since such currencies could easily be used for money laundering and are hard to monitor. Highly anonymous coins like Monero, Dash and Zcash could be forced out of the mainstream.

In order to prevent another Coincheck incident, crypto exchanges must better protect customer assets and report audit results to the association. “Customers’ private keys, which are needed to complete transactions, must also be managed offline to minimize hacking risk,” the publication described.

Furthermore, “exchanges will be required to keep their quoted rates from widely deviating from the prevailing market rates. Exchanges would also need to introduce circuit breakers to halt trading should a currency’s value suddenly surge or plunge.”

Strict and Costly Compliance All Around

Following the hack of Coincheck in January, the FSA has tightened its oversight of crypto exchanges including imposing stricter registration requirements and on-site inspections.

The agency has handed out a number of business improvement orders as well as suspended a few exchanges. Out of the 16 registered exchanges, only two were issued business improvement orders – GMO Coin and Tech Bureau. Prior to the Coincheck hack, Japan had 16 “deemed dealers” or those exchanges which were allowed to operate while their applications are pending. However, since the FSA started strengthening its rules, eight of them have indicated that they will withdraw their applications.

The agency has handed out a number of business improvement orders as well as suspended a few exchanges. Out of the 16 registered exchanges, only two were issued business improvement orders – GMO Coin and Tech Bureau. Prior to the Coincheck hack, Japan had 16 “deemed dealers” or those exchanges which were allowed to operate while their applications are pending. However, since the FSA started strengthening its rules, eight of them have indicated that they will withdraw their applications.

The JVCEA was established in March, also in response to the Coincheck hack, in order to regain public trust in the crypto industry. The association consists of the 16 government-approved crypto exchanges. The chairman and president of the organization is Taizen Okuyama of Money Partners. Bitflyer CEO Yuzo Kano is the Vice Chairman, along with Bitbank President Noriyuki Hiroeno. The other two directors are SBI Virtual Currencies’ Yoshitaka Kitao and GMO Coin’s Tomitaka Ishimura.

In addition to the JVCEA, Japan already has two older associations: the Japan Blockchain Association (JBA) and the Japan Virtual Currency Business Association (JCBA).

According to the news outlet, the JVCEA has drawn up nearly 100 pages of self-regulatory measures which could be costly for crypto exchanges to comply with. An official at one exchange was quoted saying:

We’re being subjected to rules almost as tough as the Financial Instruments and Exchange Act.

What do you think of the association’s self-regulatory rules? Let us know in the comments section below.

Images courtesy of Shutterstock and the JVCEA.

Need to calculate your bitcoin holdings? Check our tools section.

The post All Regulated Japanese Exchanges to Self-Prohibit Insider Trading and Privacy Coins appeared first on Bitcoin News.

Powered by WPeMatico