U.S. Congress has shown that it is starting to care about cryptocurrency as a number of lawmakers spoke up in favor of it this week. “The world Satoshi Nakamoto had envisioned is an unstoppable force” and “there’s no capacity to kill bitcoin” are some of the comments made by lawmakers. Meanwhile, the Fed chair said bitcoin is a store of value like gold and admitted that an era of many different currencies could return with the wider adoption of cryptocurrency.

Also read: G20 Leaders Issue Declaration on Crypto Assets – A Look at Their Commitments

Unstoppable Force, No Capacity to Kill Bitcoin

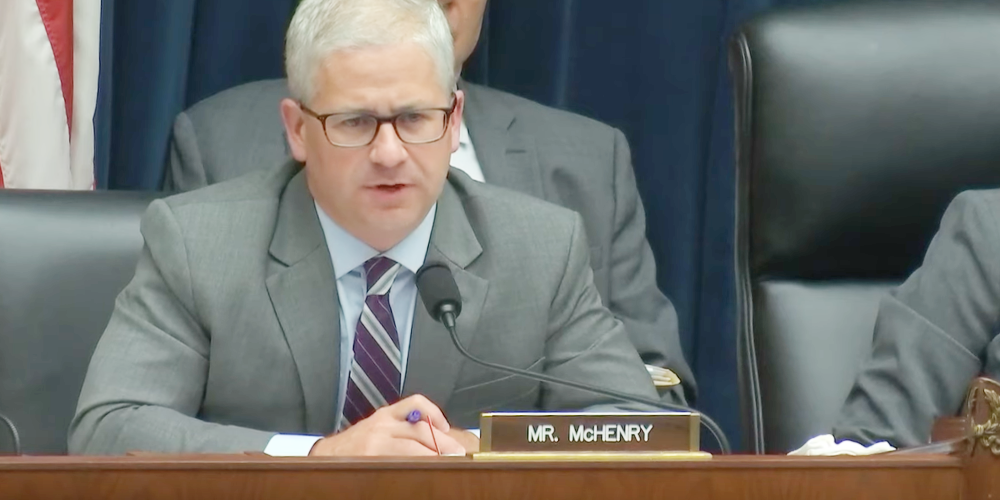

During congressional hearings on Facebook’s Libra this week, a number of U.S. lawmakers spoke in favor of cryptocurrency. Among them was Rep. Patrick McHenry, the Republican Leader of the House Financial Services Committee.

At the Committee on Financial Services hearing on July 17, McHenry said: “The reality is, whether Facebook is involved or not, change is here … Digital currencies exist, blockchain technology is real, and Facebook’s entry in this new world is just confirmation albeit its scale.” He elaborated:

The world that Satoshi Nakamoto, author of the Bitcoin whitepaper, envisioned and others are building is an unstoppable force.

The lawmaker added: “We should not attempt to deter this innovation, and governments cannot stop this innovation and those that have tried have already failed.”

While speaking at length about innovation, McHenry stated: “Some politicians want us to live in a permission-based society where you need to come to government and ask for its blessing before you can begin to even think about innovating. Those are the politicians that would rather kill it before it grows, but there are others.” He proceeded to urge his colleagues on both sides of the aisle to unite in support of innovation, declaring that his party is ready to work with innovators to implement technology in the U.S. “before we lose out to other countries around the world.”

McHenry additionally emphasized: “Due to the nature of the technology of Bitcoin, governments cannot kill it, nor should they. You can’t kill digital currencies broadly. They will be enduring. They will be strong. That is the new framework of the next generation of the internet — that is clear.”

On the same day, McHenry appeared as a guest on CNBC’s Squawk Box to discuss the hearing. When asked whether, in the long term, he believes that regulators and politicians will allow the emergence of new types of currencies, the representative replied:

I think there’s no capacity to kill bitcoin. Even the Chinese with their firewall and their extreme intervention in their society could not kill bitcoin.

Bitcoin Is Store of Value Like Gold

Federal Reserve Chairman Jerome Powell also made some bullish statements about cryptocurrency when he testified before the Senate Committee on Banking, Housing and Urban Affairs on July 11 regarding monetary policy and the U.S. economy.

Powell was questioned about the impact of a cryptocurrency system on the U.S. reserve currency. “If a cryptocurrency system were to become prevalent throughout the globe, would that diminish or remove the need for a reserve currency in the traditional sense?” asked Senator Mike Crapo, Chairman of the Banking Committee.

“I think things like that are possible,” the Fed chair admitted but noted that “We haven’t seen widespread adoption.” Nonetheless, he opined:

That’s not to say we won’t see it and if we do see it, yes you could see a return to an era in the United States where we had many different currencies … in the so-called, I guess, national banking era.

After using bitcoin as an example, saying that almost no one uses it for payments, the Fed chair explained that “They use it more as an alternative to gold, really. It’s a store of value. It’s a speculative store of value like gold.”

President Donald Trump also made his first-ever tweet about bitcoin on July 11. Even though he wrote that he is “not a fan of bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” many in the crypto community view the first direct tweet about bitcoin by a U.S. president as a bullish sign.

Congress Has Started to Care

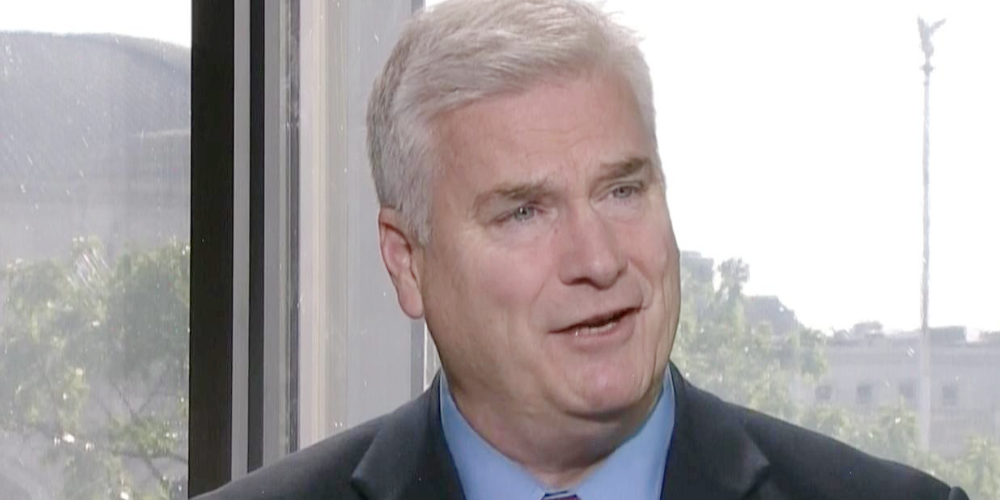

Rep. Tom Emmer also spoke at the congressional hearing on July 17. He revealed in a tweet afterward that the hearing was not only about Libra but “an opportunity to amplify a discussion on cryptocurrencies.” He suggested that “Lack of understanding by Congress and regulators will stifle blockchain technology, which stands to be a force of change for good.” During the hearing, he remarked:

I’m sure you’re aware bitcoin is now 10 years old and now suddenly, magically Congress is responding. In other words, after more than a decade, Congress has apparently started to care.

“Unfortunately some people want to unnecessarily restrict it or even ban it. They fear change,” the representative described. “Nothing has been more clear on this committee than the blind aversion to change that some of our members have constantly espoused, even when it wasn’t required or even the subject of the hearing.”

Emmer continued:

My colleagues are incredibly fearful of money laundering and criminal activity and cryptocurrencies, but the dollar and all fiat-backed currencies have been proven to be the largest means of illicit behavior and money laundering.

Nonetheless, “this does not mean we need to suppress individual freedom,” he stressed. “Individuals insistent on the exclusion of middlemen and the freedom of the individual will continue to create open networks separate from central control.” Libra, however, relies on middlemen instead of minimizing them, he explained, but believes that Facebook’s coin “presents an incredible opportunity for everyone on this committee to learn more about actual cryptocurrencies.”

‘We Will Allow for Proper Use’

Earlier this week, on July 15, Treasury Secretary Steven Mnuchin held a press conference at the White House where he talked about regulatory issues surrounding Libra and other cryptocurrencies.

Despite stating that “Many players have attempted to use cryptocurrencies to fund their malign behavior,” calling it “a national security issue,” he emphasized that “the U.S. welcomes responsible innovation, including new technologies that may improve the efficiency of the financial system and expand access to financial services.” Regarding Libra and other cryptocurrencies, the treasury secretary confirmed that “our overriding goal is to maintain the integrity of our financial system and protect it from abuse.”

Vaneck director Gabor Gurbacs commented on Mnuchin’s speech:

I thought Treasury Secretary Mnuchin had a fair and balanced view on bitcoin and digital assets. Secretary Mnuchin told the general public to play by the rules, don’t do anything illegal and there are paths forwards.

In a July 18 interview on Squawk Box, Mnuchin expressed concerns about cryptocurrency, echoing President Trump’s stance when he tweeted that “Unregulated cryptoassets can facilitate unlawful behavior, including drug trade and other illegal activity.”

Responding to Squawk Box co-host Joe Kernen suggesting that “Cash is laundered all the time and it’s all we’ve ever used for nefarious activities and we’ve certainly had plenty of them,” Mnuchin contradicted:

I don’t think that’s accurate at all that cash is laundered all the time. We have the strongest AML system in the world.

Kernen argued that “There’s been a lot of nefarious activities historically, and it’s never involved bitcoin, so obviously it’s been successfully done with cash,” but Mnuchin insisted: “I don’t think it’s successfully been done with cash, I’ll push back on that and we’re going to make sure that bitcoin doesn’t become the equivalent of Swiss-numbered bank accounts which were obviously a real risk to the financial system.”

The treasury secretary also recently called on all countries to apply the crypto standards set by the Financial Action Task Force (FATF). By adopting these guidelines, “the FATF will make sure that virtual asset service providers do not operate in the dark shadows,” Mnuchin noted. “We will allow for proper use [of cryptocurrency], but we will not tolerate the continued use for illicit activities.”

What do you think of these lawmakers’ opinions on cryptocurrency? Let us know in the comments section below.

Images courtesy of Shutterstock, C-span, and CNBC.

Are you feeling lucky? Visit our official Bitcoin casino where you can play BCH slots, BCH poker, and many more BCH games. Every game has a progressive Bitcoin Cash jackpot to be won!

The post Crypto Bullishness Spreads on Capitol Hill appeared first on Bitcoin News.

Powered by WPeMatico