Grayscale Investments has received regulatory approval to publicly quote shares of its diversified crypto fund. The product, which is the firm’s only diversified offering, invests in five main cryptocurrencies. In addition, the firm offers nine single-asset investment funds, some of which are also quoted publicly.

Also read: 7 Crypto Exchange-Traded Products Now Live on Swiss Bourse

Fund Gains FINRA Approval

Digital currency asset manager Grayscale Investments announced Monday that shares of its diversified crypto fund have been approved for public quotation by the U.S. Financial Industry Regulatory Authority (FINRA), a government-authorized nonprofit organization that oversees U.S. broker-dealers. Shares of Grayscale Digital Large Cap Fund (DLC) will be quoted under the symbol GDLCF on OTC markets. The company stated:

This marks the introduction of the first publicly-quoted security in the U.S. deriving value from a diverse selection of digital currencies.

DLC is an open-ended fund which “provides exposure to the top liquid digital assets through a market cap-weighted portfolio,” the firm described. As of Sept. 30, its components were a basket of five cryptocurrencies: 80.3% BTC, 9.9% ETH, 5.8% XRP, 2.2% BCH, and 1.8% LTC. The fund aims to cover 70% of the crypto market, and its components are reviewed on a quarterly basis. It currently has $15.7 million in assets under management and 3,194,900 outstanding shares.

The fund has been offered as a private placement to accredited investors since February last year. “Shares created through DLC’s private placement become eligible to sell into the public market after a statutory one-year holding period under Rule 144 of the Securities Act,” the firm clarified.

Single-Asset Funds

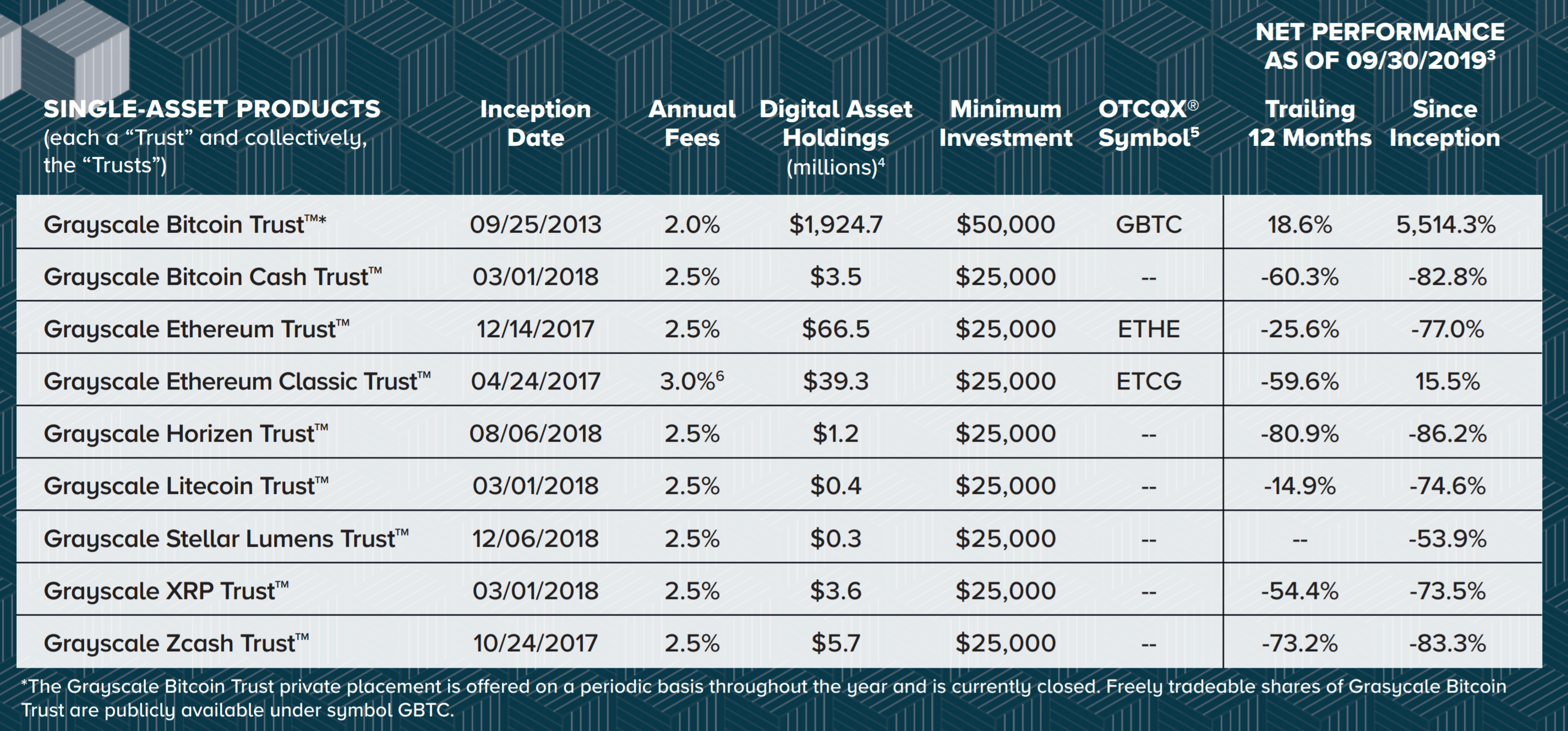

Besides the aforementioned diversified product, Grayscale offers various single-asset investment funds that provide exposure to BTC, BCH, ETH, ETC, ZEN, LTC, XLM, XRP, and ZEC. As of Sept. 30, the firm managed approximately $2.1 billion in assets.

Grayscale clarified that DLC is its fourth publicly-quoted investment product available to all investors with access to U.S. securities. The others are Bitcoin Trust (OTCQX: GBTC), Ethereum Trust (OTCQX: ETHE), and Ethereum Classic Trust (OTCQX: ETCG). Other investment funds are available to institutional and individual accredited investors.

None of the funds are registered with the Securities and Exchange Commission (SEC), which has yet to approve the first bitcoin exchange-traded fund (ETF). Last week, the commission rejected the last high-profile proposal it was evaluating, which was filed by NYSE Arca Inc. for the Bitwise Bitcoin ETF. Earlier this month, Cboe BZX Exchange Inc. withdrew its proposal for the Vaneck Solidx Bitcoin Trust, which is now offered under Rule 144A.

What do you think of Grayscale’s crypto funds? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and Grayscale.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Diversified Crypto Fund Receives FINRA Regulatory Approval appeared first on Bitcoin News.

Powered by WPeMatico