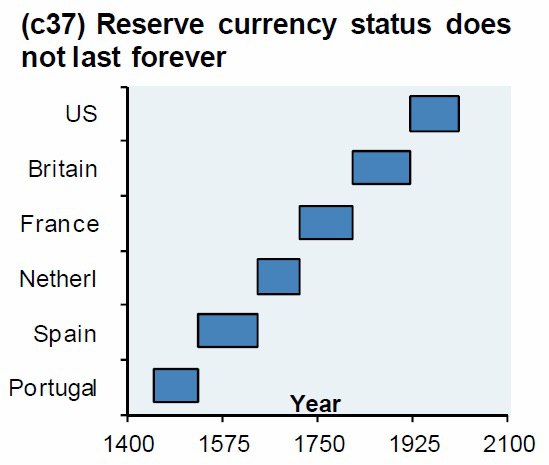

The story of reserve currencies is long and stretches far back into ancient times. As modern history shows, however, the average lifespan of fiat reserve assets is just around 100 years. This means that even the U.S. dollar’s period of dominance is probably nearing its end very soon, statistically speaking. But it’s not mere guesswork, as there are distinct patterns that emerge prior to the fall of any world reserve currency. In this exploration, three of the most common will be highlighted.

Also Read: Germany’s Financial Crisis Invokes 5-Year Rent Freeze

Bad Omens

To understand the end of any currency’s reserve status, it’s important to be familiar with beginnings, as the former is informed by the latter. A good example of this is the case of the British pound, which prior to becoming a reserve currency was turned from silver to paper with the creation of the Bank of England. The bank was created in the wake of crushing military defeat at the hands of France, and England wished to finance the creation of a more powerful navy. The central bank was thus given sole ability to issue paper currency. War and empire building would similarly play a leading role in the British pound’s consequent fall from grace. Two other common factors emerging prior to the death of reserve currencies are increased spending and easy credit, and sanctions on free trade.

War and Empire Building

In each case where a reserve currency has gained and lost status as such, war and conquest have played an extremely centralized role. The Portuguese succession crisis of 1580 caused by the battle of Alcácer Quibir, meant the end of the country’s already struggling empire. Increased reliance on finance from conquered lands, excessive taxation and a shriveling domestic economy resulted in the fall of Portugal’s various currencies from world reserve grace. Spanish money would then swoop in, assuming prominence in the context of a dynastic merger with Portugal known as the Iberian Union (1580-1640). As one struggling spice empire builder thus joined a stronger one, money such as Spain’s escudo gained worldwide reserve status and, as with Portugal, colonialism’s bloody legacy of expansion and monopolistic dominance of trade routes made this possible.

The Dutch-Portuguese War (1601-1663) would step up next, seeing the Netherlands challenge Iberian Union power, leveraging their government-created megacorporation Dutch East India Company and Dutch West India Company. The Iberian Union would fall apart, and the Dutch florin would take over as the world’s money.

The pattern is relatively clear but in case there’s any doubt, it remains unbroken to this day. The journey from florin to USD is similar. Dutch interests were overtaken by French in a series of wars and battles including the Franco-Dutch War (1672-1678), French monetary dominance was successively challenged by the iron fist of the British East India Company and its massive ‘private’ army and then, post World War I, Britain would find itself bankrupted after attempting to hold to the gold standard throughout the conflict, unable to pay with the limited asset for the excesses of modern militarism. The newly created Federal Reserve Bank in the U.S. would show up, appearing as the fiat hero, thanks to the issuance of dollar-denominated credit to foreign countries. The National Bureau of Economic Research summarizes one report, noting:

When the war began, the United States was a net debtor in international capital markets, but following the war the United States began investing large amounts internationally, particularly Latin America, thus ‘taking on the role traditionally played by Britain and other European capital exporters.’

Reckless Spending and Easy Credit

Going hand in hand with waging war and massive empire building is, of course, spending money. The irony of the British pound’s failure as reserve currency after WWI was that it faltered because it was too economically sound. The Bank Charter Act of 1844 saw the pound adopt an official gold standard. As gold is limited, and one can’t build a massive military super power with limited assets, the pound’s economic strength in the context of easy credit warfare killed it.

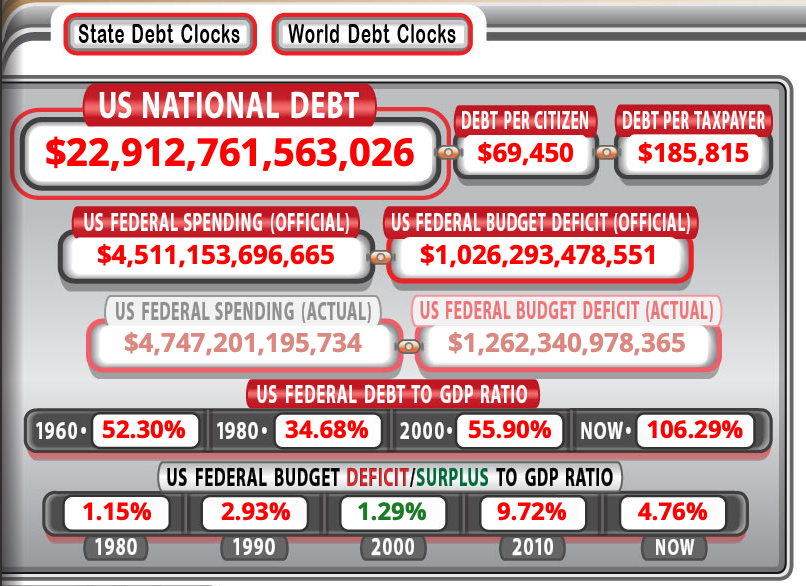

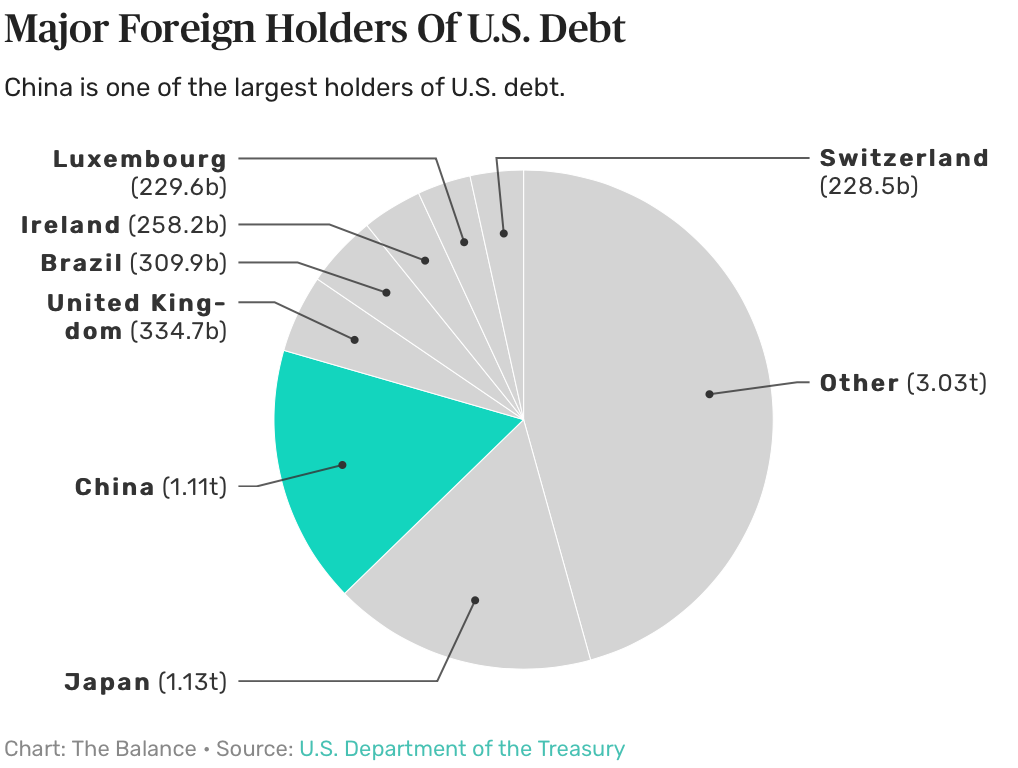

Like Portugal before the fall of its own world reserve currency, U.S. economic policies are now similarly debt-based and reckless, relying on loans from other nations, progressively desperate taxation, trade sanctions and a printing press to survive. China currently holds the largest portion of U.S. debt amongst foreign interests, with a $1.1 trillion bag to call. The U.S. continues to spend close to $1 trillion on war annually, in spite of this, with president Donald Trump even calling for major foreign powers like Saudi Arabia to pay for U.S. troops basically as mercenaries.

Where the historic paper British pound was concerned, spending for a massive navy was needed after defeat at the Battle of Beachy Head (1690), and in 1694 William III cleverly found his way around this obstacle, creating a non-government central bank that was given sole rights to issue paper currency. If this sounds eerily familiar, that might be thanks to the current U.S. government-sponsored private bank set up in strikingly similar fashion in 1913. None of this is anything new or isolated. Regarding the historic reserve status of the Dutch florin, the Federal Reserve Bank of Atlanta reports:

Where the historic paper British pound was concerned, spending for a massive navy was needed after defeat at the Battle of Beachy Head (1690), and in 1694 William III cleverly found his way around this obstacle, creating a non-government central bank that was given sole rights to issue paper currency. If this sounds eerily familiar, that might be thanks to the current U.S. government-sponsored private bank set up in strikingly similar fashion in 1913. None of this is anything new or isolated. Regarding the historic reserve status of the Dutch florin, the Federal Reserve Bank of Atlanta reports:

As a supplier of fiat money, the Bank of Amsterdam engaged in many of the same activities as central banks today. The Bank operated a large-value payment system; it provided liquidity to the Amsterdam money market through repo-like arrangements; it engaged in open market operations to stabilize market conditions; it lent to selected counterparties; and it returned seigniorage to its sponsoring government, the City of Amsterdam.

Repo like arrangements are the norm today, centuries later. The report goes on to detail that “The end of currency’s reserve status is a rare event, and the florin’s downfall teaches that preeminence of a central bank does not necessarily guard against fiscal overexploitation or a sudden loss of market confidence.”

Trade Wars and Sanctions

As recently reported, “China has reduced its holdings of U.S. debt since November 2013, when it held $1.3 trillion. It wants to allow its currency, the yuan, to rise. To do that, China had to loosen its peg to the dollar. That made the yuan more attractive to forex traders in global markets. China’s economy is also slowing down due to President Donald Trump’s trade war.”

With the lifespan of USD reserve hegemony approaching a statistically expected death rattle, many economists view the Chinese yuan as the next big contender for world reserve currency status. After all, the historical formula is all there: perpetual U.S. warfare, reckless lending, and hubristic sanctions on free trade both domestically and abroad, shriveling the U.S. economy and starving others of much needed resources. The battle for dominance of oil echoes history’s battle for sugarcane and spice. Even food is quite literally being hoarded and withheld from starving individuals just as it was in times past.

Sanctions cutting off Iraq, Iran and Venezuela from free trade, and tariff battles between the current world superpowers rage on, unabated. No different, in essence, from the seafaring mayhem of history. However, borders are now disappearing. Money can now be digitized. The next world reserve currency could be China’s anticipated and already announced digital yuan. Should that be the case, a completely surveilled world reserve monetary currency would not be hard to imagine. That is, unless individuals demand sounder options not as readily subject to the the whims of kings and queens, politicians or central banks and their borders, and not the tools of modern day colonialists wishing only to establish tax farms on planet Earth.

What do you think will be the next world reserve currency? Let us know in the comments section below.

Images courtesy of Shutterstock, fair use.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post 3 Major Signs That Precede the Fall of World Reserve Currencies appeared first on Bitcoin News.

Powered by WPeMatico