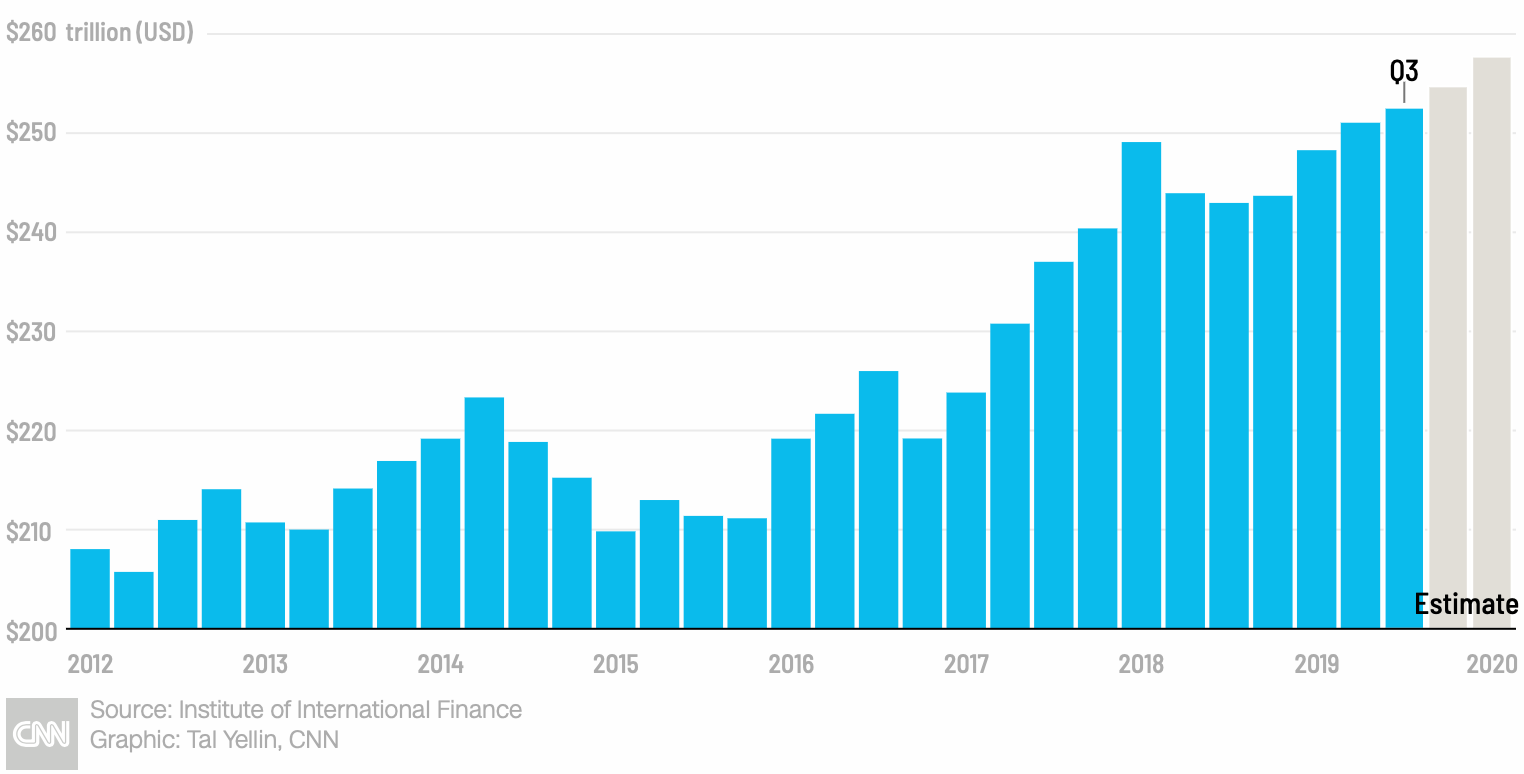

Global debt records were broken in 2019, but that likely won’t be the end of such ominous economic milestones, the Institute of International Finance (IIF) predicts. The number could reach $257 trillion sometime in Q1 2020, according to a recent report by the group. Economies worldwide are struggling to address pressing issues such as stimulation near or below the zero bound, liquidity crisis, and the effects of negative rates on banks and their customers. Some experts believe the world may in fact be gearing up for a financial crisis of frightening proportions.

Also Read: Fed Officials Ponder Funding Hedge Funds and Private Brokers Directly

Global Debt Could Hit $257T Says IIF

According to the IIF, “The global debt-to-GDP ratio hit a new all-time high of over 322% in Q3 2019, with total debt reaching close to $253 trillion.” The pronounced trajectory into the red seems to be continuing unabated. It also appears to the IIF ready to set new records in early 2020, with the institute asserting:

Global debt is set to grow faster in 2020 and is estimated to exceed $257 trillion by the end of Q1 2020, driven mainly by non-financial sector debt.

According to the IIF’s Global Debt Monitor report, China leads the way in leverage, racking up the IOUs with a 310% debt-to-GDP ratio. Developed markets such as the U.S., Europe and Japan contribute to over half of the massive global minus sign, though emerging markets have shown a rapid acceleration in recent years. The report notes that most of the debt is non-financial sector in nature, with global government debt on path to pierce $70 trillion itself. As Reuters’ Marc Jones points out in a recent report:

The amount works out at around $32,500 for each of the 7.7 billion people on planet and more than 3.2 times the world’s annual economic output…

“Spurred by low interest rates and loose financial conditions, we estimate that total global debt will exceed $257 trillion in Q1 2020,” the IIF report asserts. It further notes that household debt-to-GDP is reaching record highs in multiple countries, largely in the EU, and that government debt-to-GDP has hit record highs in the U.S. and Australia.

Negative Rates and Unending Stimulation Result in Fewer Remedial Options

As news.Bitcoin.com’s Jamie Redman recently reported, concerns about a global economic bubble are growing, with some predicting a downturn of unprecedented proportions in light of exhausted options. Raphael Bostic, Federal Reserve Bank of Atlanta President, stated this week that “There’s not a lot that we have left to do to stimulate.” U.S. interest rates were chopped three times in the latter part of 2019, and massive printing of new money characterizes an ongoing Hail Mary-type bid to stimulate the economy.

In the EU the zero lower bound (ZLB) on interest rates has long since been broken, but the European Central Bank faces a similar lack of options. While associated publications suggest that as long as there’s confidence in the system, rates can continually go lower and lower, this type of economic “faith” has been broken many times, historically.

The advent of central bank digital currencies further presents the potential for central banks like the ECB to pin negative rates directly to currencies, making it impossible for small-time savers to preserve value by moving money out of banks.

The Potential New Bubble and Bitcoin

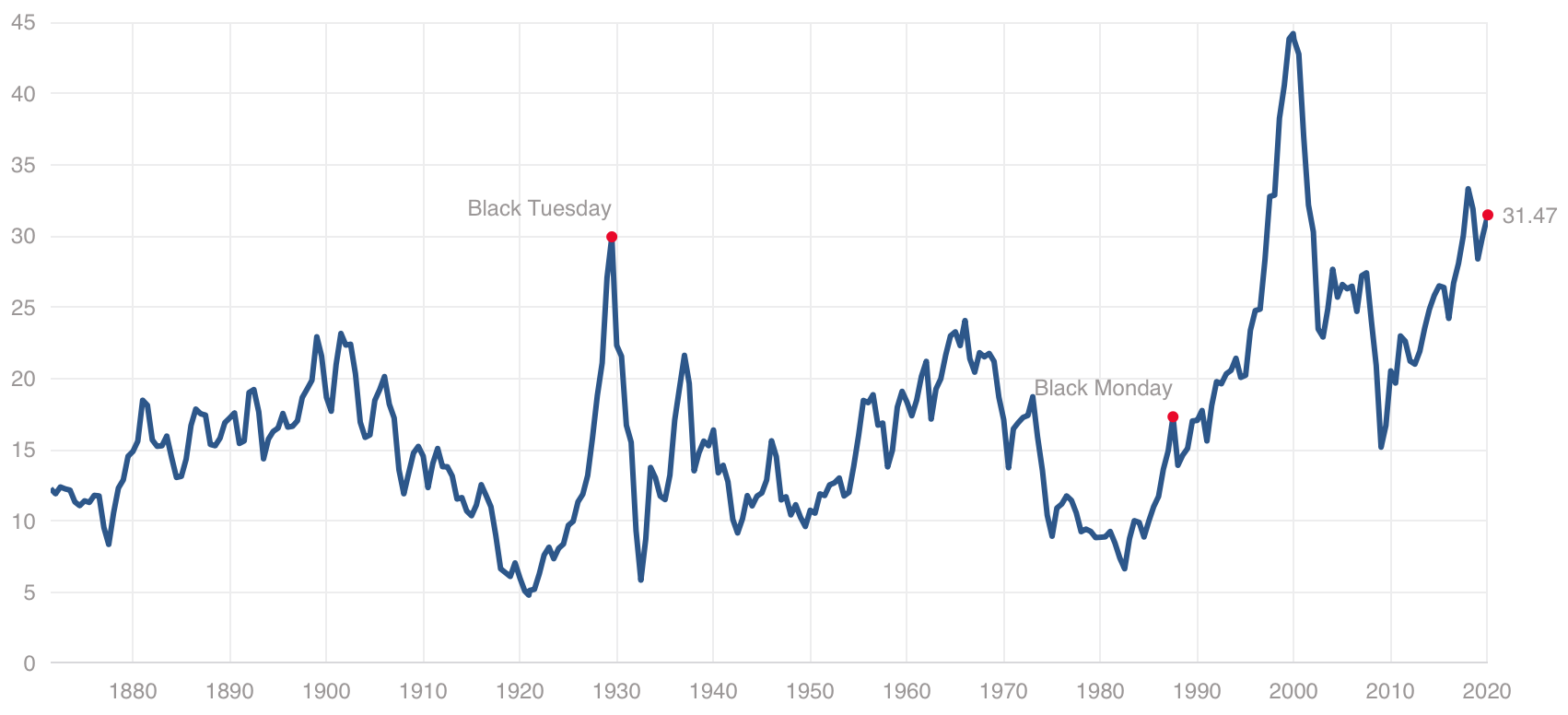

If current alarming factors such as a potentially overvalued stock market, newly increased limits on home loans, low to negative interest rates, ongoing printing of new money and a soaring global debt continue unabated, a new recession could be on the way.

Economist Robert Shiller recently attributed market confidence to contempt for traditional economic wisdom, writing in a New York Times article: “High animal spirits in the stock market are often associated with the disparagement of traditional authority and expert opinion.” Shiller cited the “Make America Great Again” narrative of the Donald Trump presidency and its contribution to current fearlessness, writing:

The rise of an explicit belief in irrationality like this one is troubling on many levels.

With all this in view, the recurring narrative of decentralized, permissionless cryptocurrencies as hedge against economic uncertainty emerges powerfully once again, even in mainstream media.

I bought #Bitcoin because I don’t want all my savings in dollars. What if my government prints lots of dollars and they become worth… pennies?

But is owning bitcoin really a good idea? @NaomiBrockwell and @PeterSchiff debate: pic.twitter.com/TwEaGiiGSJ

— John Stossel (@JohnStossel) December 15, 2019

With the first month of 2020 already half over, and crypto markets moving dynamically against the uneasy backdrop of a debt-addled world economy, coming months promise to be eventful, if largely uncertain.

What do you think about the current global debt and the state of the global economy? Can bitcoin help people avoid the negative effects of a potential crisis? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock, fair use.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post IIF Report Predicts Global Debt Will Reach New All-Time High of $257T in 2020 appeared first on Bitcoin News.

Powered by WPeMatico