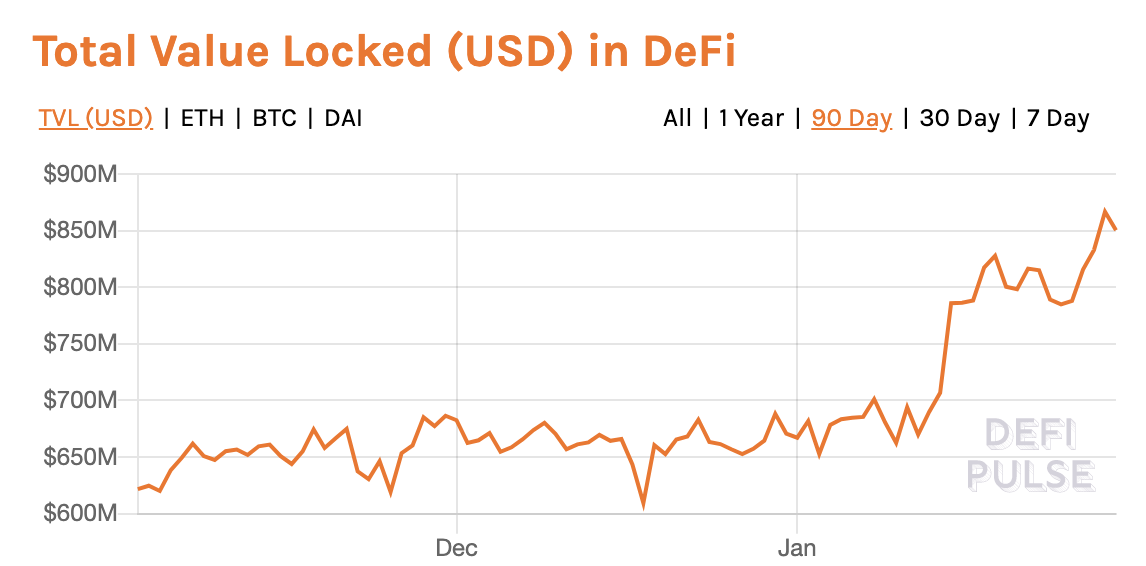

The defi market has hit an all-time high as the total value locked up in decentralized finance has surged past $850 million. A flurry of new applications, privacy proposals, wallets, DEXs, and protocols is extending the limits of what defi is capable of. This jubilation should be countered with a healthy dose of caution, however, for not all of the products sailing under the defi flag are as decentralized as they claim. In some cases, what’s being branded as defi isn’t defi at all – it’s just finance, with the same chokepoints and centralized controls as before.

Also read: Cold Storage and Bearer Bonds: How to Print an SLP Token Paper Wallet

Decentralized Finance Products Are Proliferating

Of the $850M currently locked into defi, $490M is contained in Maker, whose collateralized stablecoins, and the array of defi products they engender, account for 57% of the sector’s value. Other defi mainstays include derivatives, courtesy of Synthetix ($147M locked up), and lending care of protocols like Compound ($104M) and Instadapp ($62M), followed by DEXs such as Uniswap ($48M). The predominantly Ethereum-based products that can be lumped under the defi banner look to be in rude health, even if their market size is a fraction that of Ethereum’s previous use case – ICOs.

This month alone has seen the Ethereum ecosystem welcome projects such as Syscoin’s bridging protocol, social trading from Set Protocols, loans collateralized with NFTs courtesy of Rocket, and token curated registries (TCRs) from dispute resolution protocol Kleros. Of these, Syscoin Bridge aims to advance the defi narrative by improving interoperability via a decentralized link to the Syscoin ecosystem, combining the higher throughout and low network fees of the latter with Eth’s smart contracting capabilities. As a result, value can move freely between the two networks using a trustless, censorship-free protocol that increases token fungibility. Given that Plasma is effectively now dead in the water, access to decentralized scaling solutions has taken on a renewed urgency.

Kleros, for its part, has developed a general TCR that can be used to create crypto-economic backed lists of anything, from verified social media accounts to lending dapps to darknet markets. It’s also been integrating its decentralized arbitration system into defi platforms, and the team’s endeavors appear to be bearing fruit. While one should be cautious of information obtained from anonymous imageboards, the proliferation of Kleros threads on 4chan’s /biz/ suggests the link marines may have found a new project to latch onto. If the justice as a service protocol can’t 10x through cornering the defi market, perhaps it can be memed to the moon courtesy of the same ‘weaponized autism’ that saw Chainlink turned into a $1 billion project.

Open Finance or Permissioned Protocols?

“The value of decentralized finance is lost if underlying instruments cannot serve sovereignty because of skewed incentives or attack vectors stemming from a lack of decentralization,” notes Syscoin co-founder and Lead Core Developer Jagdeep Sidhu. “The only successful way to build a blockchain protocol is to begin and end with decentralization as the focal-point. Trade-offs made at the core layer, such as relaxing mining or other requirements of the decentralized ideals Satoshi gave us, introduce loss of value proposition to anything built on top.”

Creeping centralization doesn’t just manifest in defi protocols whose creators hold the master keys; it can also be seen in projects such as Pool Together, the lossless lottery platform, where whales have taken over. There is nothing illegal about major players gaming the system, nor does their doing so put user funds at risk. However, it serves to illustrate the ease with which the defi market can be manipulated – and how projects founded with good intentions can be hijacked by monopolies with little interest in fostering financial inclusion.

1/9

Let’s talk about what I’m calling “The Wealth Attack” in DeFi.

Scale is crucial to decentralized projects to prevent against whale manipulation.

Example @PoolTogether_ where whales have bulk bought tickets. The top 5 players combined have a 58% chance of being the winner. pic.twitter.com/AGydg2QkXp

— Adam Cochran (@AdamScochran) January 26, 2020

“Decentralized finance isn’t possible without interoperability,” insists Jagdeep Sidhu, who is convinced that reliance on Ethereum alone to carry the defi movement is a recipe for disaster. “One platform will not be capable of supporting global demand without being centralized, and at that point it is essentially traditional finance. Proper interoperability bridges provide decentralization for users and systems, alleviate scaling pressures, and empower users to determine their own speed/security trade-off. When these interoperability solutions are adopted, people who currently lack access to financial instruments as basic as a bank account will find it easier to take back control of their own financials and achieve sovereign ownership in a decentralized, trustless, and censorship-free way.”

Eliminating Susceptibility to Censorship

While well-secured blockchains such as Bitcoin and Ethereum are virtually impossible to stop, censorship can manifest in more insidious ways. Shut down the websites and apps that package defi into a user-friendly product and you’re left with protocols that must be queried directly to collateralize stablecoins, issue loans, and trade tokens. Thus, even defi protocols that do not contain backdoors or central levers are reliant on an application layer that must withstand the ever-present threat of censorship. “There is a danger of short-sighted design changes leading to increasingly centralized defi solutions sold as ‘holy grails,’” finishes Jagdeep Sidhu.

The maturation of defi base layer protocols such as Maker has fueled innovation at the application layer, where new concepts are being proposed on a weekly basis. Some won’t make it past the theoretical stage, but others will make it to MVP and beyond. The defi movement feels very much like the early Bitcoin or the current Bitcoin Cash movements: lots of experimentation, free-thinking, and solo projects that advance the collective understanding of what can be done with crypto technology.

The defi sector might be in rude health, but its architects would do well to look to Bitcoin and the trade-offs it’s suffered over the years through federated sidechains like Liquid and decreased fungibility that’s enabled Know Your Transaction surveillance and privacy violations. The defi dapps that stand the test of time won’t just be unputdownable – they’ll also be ungamable and uncensorable.

Do you think most defi protocols and applications are truly decentralized? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post Decentralized Finance Is Blossoming, But Just How Decentralized Is Defi? appeared first on Bitcoin News.

Powered by WPeMatico